With the ever-evolving landscape of financial opportunities in 2024, you have a unique chance to explore various passive income streams. This informative guide will introduce you to the top ideas that require minimal time investment while maximizing your financial growth. Whether you’re aiming to bolster your savings or venture into new entrepreneurial avenues, these strategies will help you build a steady income stream with ease. Get ready to take your first steps towards financial independence with the best passive income ideas designed specifically for beginners.

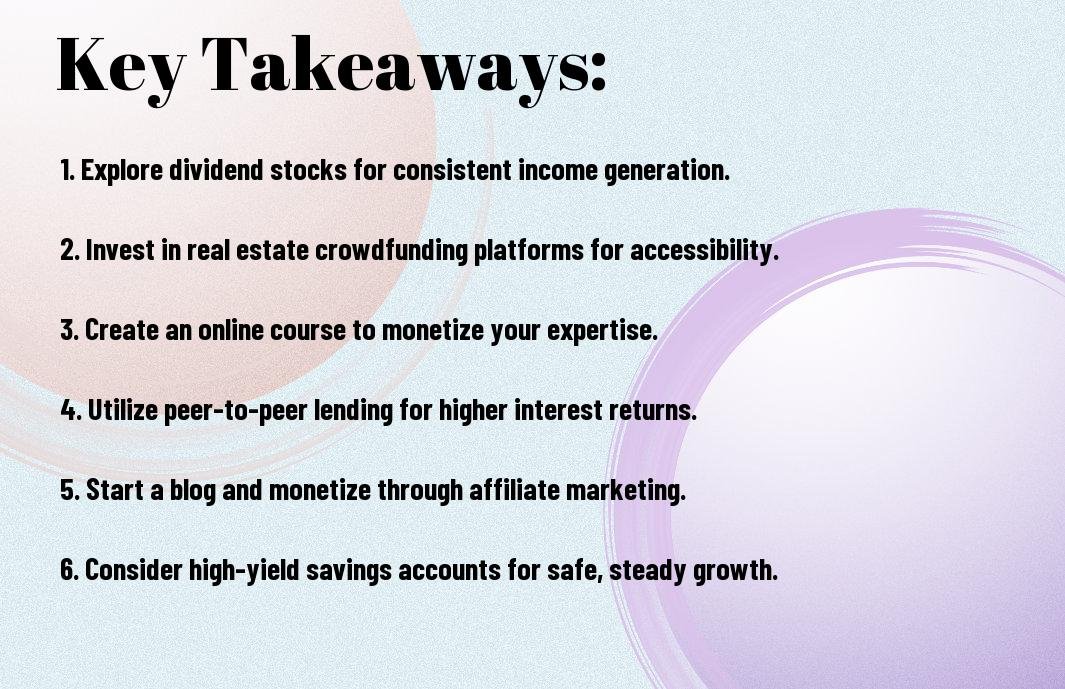

Key Takeaways:

- Diversify your income sources: Explore various passive income streams such as real estate investments, dividend stocks, and peer-to-peer lending to build a robust financial portfolio.

- Embrace technology: Leverage digital platforms for passive income opportunities, like creating online courses or earning from affiliate marketing.

- Start small: Focus on manageable investments or projects that require lower initial capital, allowing you to gradually grow your passive income capabilities.

Understanding Passive Income

Before submerging into passive income opportunities, it’s important to grasp the concept itself. Passive income allows you to earn money without actively working for it on a daily basis. It provides you with the flexibility to focus on other pursuits while your money works for you, creating a sense of financial freedom.

What is Passive Income?

What defines passive income is the ability to generate earnings through investments or business ventures that require minimal daily effort. Unlike traditional employment, where you exchange time for money, passive income allows you to set up systems that continue generating revenue over time.

Benefits of Passive Income

After you understand the concept, you’ll discover the many advantages of passive income. It diversifies your revenue streams, providing you with financial stability and security. This financial flexibility allows you to pursue your passions, travel, or simply enjoy your time without the stress of a 9-to-5 job.

With passive income, you can build a safety net that protects you from unexpected expenses or losses in your primary income source. Moreover, it opens opportunities for compounding earnings, enabling your investments to grow exponentially over time. This kind of financial independence enhances your overall quality of life, offering you the freedom to explore new ventures or spend time with loved ones without worrying about your finances.

Investing in Real Estate

Any beginner looking to create passive income can benefit from investing in real estate. This venture allows you to leverage various strategies to grow your wealth while generating revenue. If you want to learn more about top ideas in this domain, check out 25 Passive Income Ideas To Help You Make Money In 2024.

Rental Properties

Above all, owning rental properties can be an excellent way to generate consistent monthly income. When you purchase a property and lease it to tenants, you’ll receive regular rent payments that can create a steady cash flow. Additionally, as property values rise over time, your investment can appreciate, further boosting your profits.

Real Estate Investment Trusts (REITs)

Between direct property investments and REITs, the latter offers a more accessible entry point for passive income. Investing in REITs allows you to profit from real estate markets without the need to manage properties directly.

And, REITs are companies that own, operate, or finance income-generating real estate across various sectors. When you buy shares in a REIT, you benefit from the income produced by the properties they manage, typically through dividends. This approach makes it easier for you to diversify your investments and potentially enjoy returns without the hands-on effort of traditional property management.

Dividend Stocks

Keep in mind that dividend stocks can be an excellent way to generate passive income, especially for beginners. These stocks pay out a portion of their earnings to shareholders, allowing you to benefit from both stock price appreciation and regular income distributions. By investing in reliable companies with a history of dividend payments, you create a steady revenue stream that can enhance your financial situation over time.

What are Dividend Stocks?

On a basic level, dividend stocks are shares of companies that return a portion of their profits to shareholders in the form of dividends. These can provide a consistent income source while you hold the stock, differentiating them from growth stocks that reinvest profits back into the business. Many well-established companies offer dividends, showcasing financial stability and a commitment to rewarding their investors.

How to Start Investing

Against popular belief, starting to invest in dividend stocks doesn’t require a lot of capital. You can begin by researching reputable online brokerages that offer commission-free trades, making it easier for you to buy shares without significant fees. Start by identifying companies with a proven track record of paying dividends and consider diversifying your investments across sectors to minimize risk.

Dividend stocks have a variety of entry points for beginners, and you should start by opening a brokerage account that aligns with your long-term investment goals. Focus on companies with a sustainable payout ratio and a history of consistent dividend increases, which are more likely to provide you with steady income over time. Setting up a dividend reinvestment plan (DRIP) can also be a smart move, allowing you to automatically reinvest your earnings into more shares, further compounding your returns.

Peer-to-Peer Lending

Your introduction to peer-to-peer (P2P) lending can potentially open up new income avenues. With just a few clicks, you can connect with borrowers seeking funds and earn interest on your investments. This model allows you to lend money directly to individuals or businesses through online platforms, bypassing traditional financial institutions. It’s an easy entry point for beginners looking to diversify their income sources.

Overview of P2P Lending

Across the evolving financial landscape, P2P lending has gained traction as an accessible option for individuals to invest. This method allows you to lend money directly to borrowers while earning interest, creating a win-win scenario. As more specialized platforms emerge, you can easily explore diverse investment opportunities tailored to your risk tolerance and financial goals.

Risks and Rewards

Below the appeal of passive income through P2P lending lies a landscape filled with both risks and rewards. While you can potentially earn higher returns compared to traditional savings accounts, there’s the possibility of borrowers defaulting on their loans. Your ability to assess risk versus reward will be key in deciding how much to invest.

Hence, understanding the balance between risk and reward is important in P2P lending. You can achieve respectable returns, but it’s important to carefully research the lending platform and borrower profiles. Diversifying your investments across multiple loans can mitigate potential losses, ensuring your passive income stream remains steady while you navigate the inherent uncertainties of lending.

Creating Digital Products

All aspiring entrepreneurs can tap into the potential of digital products to generate passive income. By creating valuable content that caters to specific audiences, you can leverage your skills and knowledge while enjoying the benefits of online sales. The beauty of digital products lies in their scalability; once created, they can continue to sell without ongoing effort, providing you with a steady income stream.

E-books and Online Courses

The digital landscape is ripe for e-books and online courses that share your expertise. By packaging your knowledge into bite-sized lessons or comprehensive guides, you can offer valuable resources that cater to learners’ needs. Platforms like Amazon Kindle and Udemy make it easy for you to reach wide audiences and generate income while helping others grow.

Printables and Visual Content

About printables and visual content, these offerings can attract buyers looking for unique designs to enhance their lives or businesses. Printables can include planners, journals, or wall art, allowing you to showcase your creativity. You can sell these products in online marketplaces like Etsy or your website, providing a steady source of passive income.

Even beginners can successfully create and market printables with the right design tools and a clear target audience in mind. By focusing on trends and identifying niches, you can produce designs that resonate with potential buyers. With minimal overhead costs, printables provide an excellent entry point into the world of digital products, allowing you to earn money while sharing your artistic talent.

Affiliate Marketing

Now is the perfect time to explore Passive Income Ideas 2024: Make Money Without Working, and affiliate marketing is a fantastic option for beginners. This method allows you to earn commissions by promoting products or services through unique referral links. With the right approach, you can generate income while focusing on other projects or your main job.

How Affiliate Marketing Works

An affiliate marketing program connects you, the affiliate, with a business looking to sell products or services. When you share your unique link through a blog, social media, or website, you earn a commission for every sale made through that link. It’s a win-win situation, as businesses can reach a wider audience while you earn passive income for promoting their offerings.

Building an Effective Strategy

Above all, developing an effective strategy for affiliate marketing is key to your success. Start by identifying a niche that aligns with your interests and has a potential audience. Then, research affiliate programs that fit well within that niche and offer competitive commissions. Creating engaging content that highlights the value of the products will help build trust with your audience and drive sales.

To refine your affiliate marketing strategy, focus on building a strong online presence through quality content and consistent engagement with your audience. Utilize various platforms such as blogs, social media, and email newsletters to promote your links. Monitor performance metrics to understand which strategies work best, and don’t hesitate to adjust your approach based on your insights. By continuously optimizing your efforts, you can maximize your passive income potential in affiliate marketing.

To wrap up

Hence, exploring top passive income ideas for beginners in 2024 can empower you to build wealth while minimizing active involvement. By diversifying your efforts across options like online courses, rental properties, or dividend stocks, you position yourself for financial growth. Each strategy requires varying degrees of initial investment and effort; therefore, assess which aligns best with your interests and resources. Begin your journey toward financial independence today, and let these passive income streams work for you.